Modernizing the 529 Financial Advisor Portal: A UX Redesign for Inclusion, Clarity, and Control

The NEST Direct College Savings Plan portal was outdated, unintuitive, and misaligned with modern user expectations. As the Lead UX Designer, I led research, strategy, and design for a full platform redesign in collaboration with Union Bank & Trust, Centric Park, and Envision Financial Systems. By centering the user experience around investor goals, system flexibility, and financial clarity, we delivered a responsive, accessible, and confidence-building product that better supports both financial advisors and investors.

Problem

The original portal was outdated, inconsistent with brand standards, and difficult to use.

Key pain points included:

Non-responsive design that failed on mobile and tablets

Friction in core workflows like opening accounts, contributing, or withdrawing

Poor financial transparency (e.g., contribution impacts, performance insight)

Overwhelming choices with limited guidance

Confusing, industry-specific terminology and questions that users couldn’t answer

These issues created a frustrating experience for investors and advisors, decreasing satisfaction, adoption, and confidence.

Solution

We overhauled the portal experience with a human-centered, agile process.

Core design improvements included:

Responsive design across all screen sizes

Goal-driven contribution and investment flows

Editable, flexible tools for recurring and one-time transactions

Clear financial projections and contextualized information

Search, filters, and visual summaries to reduce cognitive load

Simplified language and reduced jargon to build trust

Each sprint cycle focused on redesigning a prioritized user flow (e.g., Contribute, Withdraw, Invest), informed by user feedback and iterative usability testing.

My Role

As UX Lead, I oversaw the research and design strategy, including:

Conducting 9 user interviews across investor and advisor personas

Leading heuristic evaluations and usability tests

Designing and testing high-fidelity wireframes and prototypes

Facilitating workshops and stakeholder alignment sessions

Delivering hi-fi Figma wireframes

Key Responsibilities

User Research

Created moderator guides, ran interviews, and synthesized findings

Validated hypotheses and uncovered insight-driven opportunities

Design Strategy

Defined and prioritized improvements based on user needs

Mapped key flows and pain points across mobile and desktop

UX Design

Produced responsive wireframes and interactive prototypes

Agile Collaboration

Worked in 2-week sprints with continuous feedback loops

Participated in weekly demos, backlog grooming, and sprint planning

CHALLENGE #1

Making Contributions Clear and Goal-Aligned

Problem: Investors didn’t understand how their contributions translated to outcomes. Financial data lacked clarity and context.

Solution:

Displayed contribution impact (e.g., $75/month = $900/year)

Used visual calculators to show progress toward goals

Linked contributions to performance summaries and forecasted results

Impact: Built user confidence, improved financial understanding, and empowered informed decision-making.

CHALLENGE #2

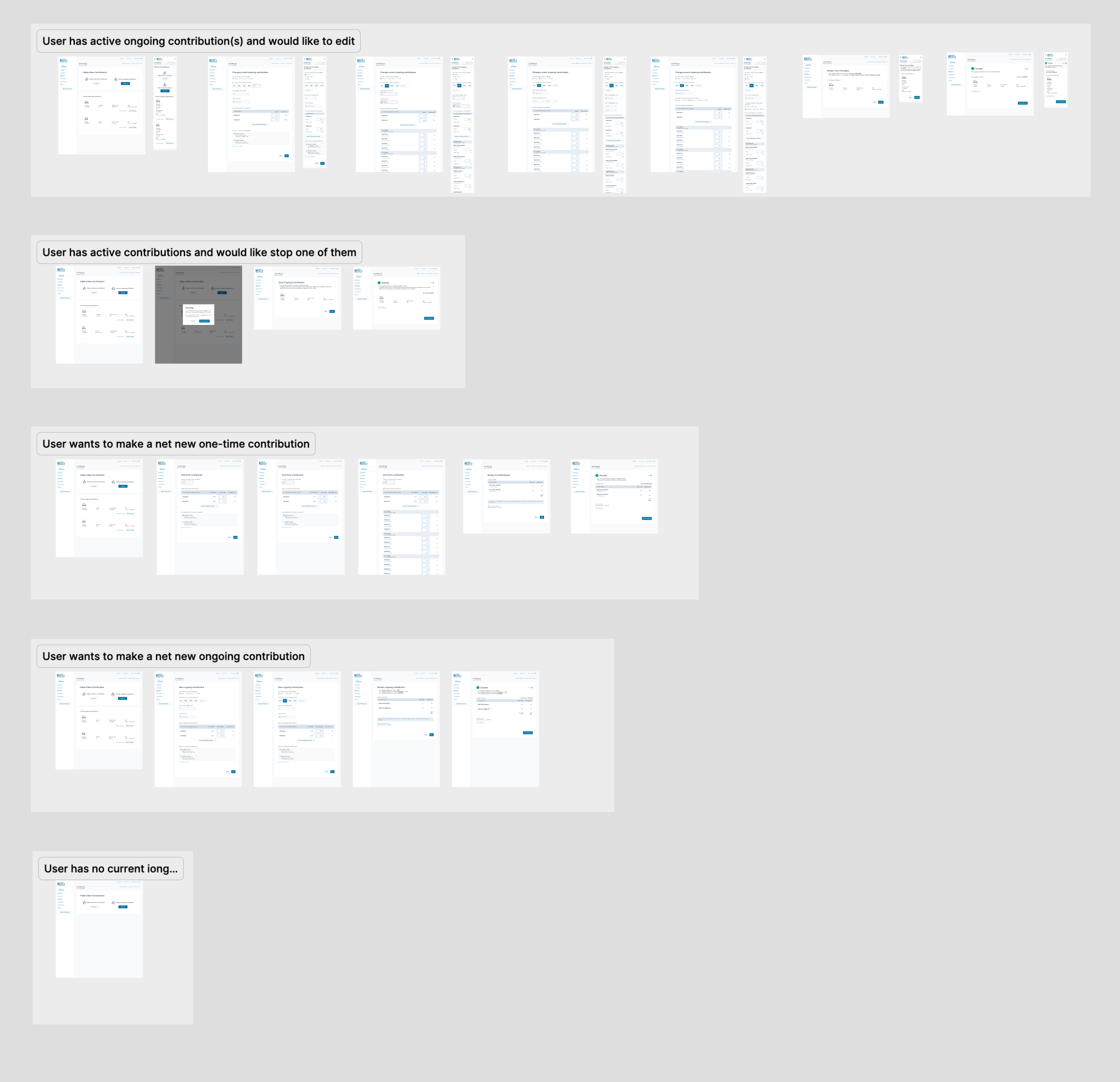

Enabling Flexibility Within the Tool

Problem: Rigid tools limited user autonomy. Investors couldn’t easily edit contributions or adjust investments.

Solution:

Enabled direct editing of contribution tables

Supported one-time and recurring contributions on the same screen

Allowed multiple withdrawal types in one flow

Impact: Gave users more control and reduced friction, boosting satisfaction and reducing support needs.

CHALLENGE #3

Helping Users Feel Informed, Not Overwhelmed

Problem: Too much information, poor structure, and unclear terms lead to confusion.

Solution:

Improved terminology and labeling (e.g., "One-Time" vs "Recurring")

Surface key investment metrics and tooltips

Used graphs, visuals, and infographics to simplify complex data

Impact: Increased comprehension, trust, and ease of navigation across all investor types.

CHALLENGE #4

Reducing Overload from Too Many Options

Problem: Users were overwhelmed by long, undifferentiated fund lists.

Solution:

Introduced search and filtering tools

Highlighted the top 3 recommended options with rationale

Collapsed or grouped similar funds and showed relevant summaries

Impact: Improved decision-making and made investing feel manageable, not paralyzing.

CHALLENGE #5

Avoiding Questions Users Can’t Answer

Problem: Investors were asked confusing questions they weren’t prepared for.

Solution:

Reworded industry jargon into simple, understandable prompts

Provided helpful guidance and clear follow-ups for complex options

Moved confusing questions later in the flow and separated them into manageable pieces

Impact: Reduced drop-off, confusion, and user anxiety. Boosted confidence in navigating the platform.

Outcome & Reflection

The redesigned portal met modern accessibility and responsiveness standards, aligned with brand guidelines, and delivered a more empowering, user-friendly experience. By integrating feedback into every sprint and focusing on clarity, flexibility, and support, the team delivered over 50 targeted UX improvements that had lasting impact.

This project reinforced the value of leading with empathy, designing with data, and iterating with intention. The result was a platform that not only looks modern, but makes investing in education approachable and effective.